Forex Introduction

The first step is to educate yourself about foreign exchange trading by watching tutorial videos and reading how to trade forex articles. Trading forex is like any other skill, it just takes some time to learn.

The Basics of

Forex Trading

Foreign exchange is the process of exchanging one currency for another, for example, when you transfer money from your Euro bank account into a USD account.

Trading forex is the skill of profiting from a rise or fall in a currency pair. The main instrument for trading forex is the Contract for Difference (CFD). The trader makes a profit or loss on the difference between the entry price and exit price of a currency pair like the EURUSD or GBPUSD.

CFDs can also be used to trade on commodities, indices, shares and precious metals.

Spreads and Commissions

The spread is the difference between the bid and ask price. The bid price is what the forex broker offers and the ask price is what the trader is willing to pay. The difference between them is called the spread and is the broker’s income.

Commissions are usually charged on the volume of your trade. Trades are measured in lots. The standard lot is 100,000 units of currency and you can also buy mini lots at 10,000 units, micro lots at 1000 units and nano lots for 100 units.

It’s good practice to check your broker’s spreads and commissions to make sure they are competitive compared to the rest of the market so you are not paying too much to trade.

There are three more key points to keep in mind about the costs of trading.

01

Leverage

Leverage is additional capital added to your trade by the broker, boosting the amount of lots you can buy and potentially increasing your profits. There is no interest charged on leverage.

02

Margin

Margin is a percentage of your deposits which is retained by the broker to make sure your trades are covered.

03

Swap charges

When holding a trading position open overnight, forex brokers normally charge interest on the trade’s amount. This is to cover any overnight charges from banks.

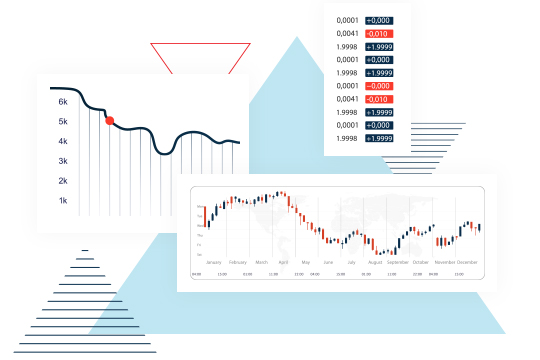

Forex Analysis

Forex trading isn’t done by looking into a crystal ball, traders do not rely on luck most of the time. Instead, they use forex analysis.

Technical analysis offers insights into price directions with charts which show patterns, trends and momentum.

Fundamental analysis is the art of understanding how market events and economic news can help you predict price movements.

What is Paypal?

Payment processor Paypal is a major e-wallet and often used by forex traders to fund their accounts with brokers who accept the payment method. It’s considered to be reliable, secure and quick. Paypal is also easy to use on desktop or mobile, making it one of the most popular ways to fund accounts and receive trading withdrawals.

Traders who prefer day trading are the forex world’s most frequent fliers as they make a good many trades on a daily basis. Paypal is an easy-to-use solution for their needs. The same goes for swing trading, a style used by traders who aim to snap up short-term profits while forex trading.

When transferring money with Paypal, it’s useful that there is a high limit of up to $60,000. However, bear in mind that chargebacks on forex are not accepted by Paypal, which only accepts chargebacks on physical goods.

It’s important to understand that both technical and fundamental analysis is based on probabilities and there is always a risk of loss in trading. However, when a trader has a deep understanding of analysis, there are better chances of successful trades in the long run.